The Central Bank of Nigeria (CBN) has assured Nigerians that it would work aggressively towards increasing financial inclusion rate to 80 per cent, by cutting down the number of people excluded from the financial system to 20 per cent in the next three years (2020).

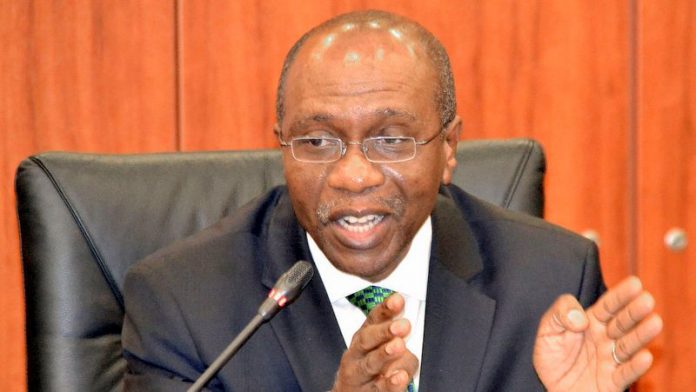

Although the CBN Governor, Mr. Godwin Emefiele noted that the target was very ambitious, he however declared that the bank had identified key strategies to cutting down the financial exclusion rate to 20 per cent by 2020, across the country. Specifically, Mr. Emefiele said that the Bank would work with the Nigerian Communications Commission (NCC) on how best to take advantage of mobile communication to reach those that were financially excluded.

In his remarks while receiving the United Nations Secretary General (Special Advocate) on inclusive Finance for Development, HRM Queen Maxima, the CBN Governor said Nigeria has moved from 46.3 per cent exclusion rate in 2010, to 41.6 per cent in 2016.

According to him, specific areas of focus identified which would be pursued aggressively include “prioritizing intervention and creating awareness to ensure patronage, incorporating non-interest financial services into CBN intervention programs.” Others are “mobilizing banks that offer such products for greater outreach and impact; massive rolling out of agents networks and creating awareness to increase adoption, and adoption of digital financial services as simple, flexible and easy alternative channels for reaching remote areas and rural hinterlands.” Mr. Emefiele said that the National Financial Inclusion Strategy was being reviewed for greater effectiveness and impact, asserting that stakeholders would be sufficiently mobilised to participate in it.

Queen Maxima, who was at the CBN as part of her working visit to Nigeria, was in the country five years ago during the launch of FSS2020. Speaking on the visit, Mr. Emefiele said: “Your visit is indeed remarkable as it demonstrates your love both for our deer country and your commitment to improving access to finance especially for the lowly placed in our society and all societies. Following our assent to the Mayal declaration in September 2011, we launched the National Financial Inclusion Strategy on October 12, 2012, in which your Majesty participated actively”.

The CBN boss continued, “Our target is to bridge 20 per cent exclusion rate by 2020, by which we are saying 80 per cent inclusion rate. Towards this, the bank introduced a number of initiatives, prominent among them – the Agent banking framework, the Know your customers framework, the micro small and medium framework; enterprise borrower program, national collateral registry, credit bureau and credit scoring system and release of national financial literacy and consumer protection frame work and other similar ones. We have introduced other reforms”.

Queen Maxima expressed delight at the opportunity to be in Nigeria at this time that the country has come out of recession.